|

skip to main | skip to sidebar

www.flyersrights.org

Intention of this blog

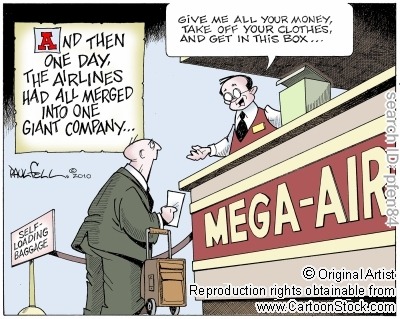

We are commited to solutions for promoting airline passenger policies that forward first and foremost the safety of all passengers while not imposing unrealistic economic burdens that adversely affect airline profitability or create exhorbitant ticket price increases.

Search This Blog

Links to Other Blogs and Posting Sites

Proposed Airline Passengers' Bill of Rights

All American air carriers shall abide by the following standards to ensure the safety, security and comfort of their passengers:

- Establish procedures to respond to all passenger complaints within 24 hours and with appropriate resolution within 2 weeks.

- Notify passengers within ten minutes of a delay of known diversions, delays and cancellations via airport overhead announcement, on aircraft announcement, and posting on airport television monitors.

- Establish procedures for returning passengers to terminal gate when delays occur so that no plane sits on the tarmac for longer than three hours without connecting to a gate.

- Provide for the essential needs of passengers during air- or ground-based delays of longer than 3 hours, including food, water, sanitary facilities, and access to medical attention.

- Provide for the needs of disabled, elderly and special needs passengers by establishing procedures for assisting with the moving and retrieving of baggage, and the moving of passengers from one area of airport to another at all times by airline personnel.

- Publish and update monthly on the company’s public web site a list of chronically delayed flights, meaning those flight delayed thirty minutes or more, at least forty percent of the time, during a single month.

- Compensate “bumped” passengers or passengers delayed due to flight cancellations or postponements of over 12 hours by refund of 150% of ticket price.

- The formal implementation of a Passenger Review Committee, made up of non-airline executives and employees but rather passengers and consumers – that would have the formal ability to review and investigate complaints.

- Make lowest fare information, schedules and itineraries, cancellation policies and frequent flyer program requirements available in an easily accessed location and updated in real-time.

- Ensure that baggage is handled without delay or injury; if baggage is lost or misplaced, the airline shall notify customer of baggage status within 12 hours and provide compensation equal to current market value of baggage and its contents.

- Require that these rights apply equally to all airline code-share partners including international partners.

Links to Stories about the Coalition

- Press Democrat 3/16/2007 - Front Page news!

- C-Span MUST SEE Kate on Capitol Hill

- New York Time feature 2/6/07

- Today Show video with Congressman Mike Thompson

- Fort Worth Star-Telegram: Angry Passengers Pitch Airline Changes 1/24

- ABC KGO San Francisco 1/24

- CBS Clip 1/24

- Kate Hanni on FOX 1/24

- Dallas Business Journal: Passengers stranded on American flights push for Passengers Bill of Rights 1/23

- Pegasus News Wire: Passengers stranded on American flights push for Passengers Bill of Rights 1/23

- Aero-News.Net: Stranded Airline Travelers Urge Lawmakers To Look At 'Passengers Bill Of Rights' 1/23

- Travel Weekly: Grassroots group argues for airline passenger bill of rights 1/23

- AV Web: Airline Passengers Demand Rights 1/23

- NBC: Trip to Dallas turns into flightmare 1/11

- The Wall Street Journal: Runway-bound: A holiday flight becomes ugly 1/9

- Dallas Morning News: Passengers stuck on plane over 8 hours 12/30

About Me

- K

- I am a 19 year veteran of Real Estate, a Stock Broker and Human Rights Advocate. I also play 12 instruments and am in a Motown band.

Blog Archive

Links to Our Friends Websites

FlyersRights.org All Rights Reserved

FORMELY THE COALITION FOR AN AIRLINE PASSENGERS BILL OF RIGHTS

design by media644.com

FORMELY THE COALITION FOR AN AIRLINE PASSENGERS BILL OF RIGHTS

design by media644.com